Working Canadians $250 Rebate: How much, who's eligible and when will it arrive

On Nov. 21, 2024, the Canadian government announced a new $250 rebate, as well as plans to scrap the GST on certain products over the holidays. Here's what to know.

What’s the Working Canadians rebate?

The federal government announced on Nov. 21 that a new rebate, called the Working Canadians rebate, would be delivered by early spring 2025. This rebate is meant to put money back in Canadians’ pockets while the cost of living remains high.

How much is the rebate?

The Working Canadians rebate is $250.

Who’s eligible for the Working Canadians rebate?

• Have worked in 2023 and earned an individual net income less than $150,000.

• Have filed your 2023 tax return by the end of 2024 and claimed certain credits.

• Be a Canadian resident as of March 31, 2025.

• Not be incarcerated for at least 90 days before April 1, 2025.

The federal government estimates a total of 18.7 million Canadians are eligible to receive the rebate.

When and how will I get my $250 rebate?

The rebates are expected to land by early spring 2025, but no specific date has been given.

Those who are eligible will receive their rebate by direct deposit, if you’re already set up for it with the Canadian Revenue Agency, or you’ll receive a cheque in the mail.

You can log into your CRA account online to set up direct deposit.

What’s the holiday GST tax break?

The federal government has also announced they’ll be temporarily suspending the goods and services tax for groceries and other holiday essentials this season. The GST relief is meant to “help (Canadians) buy the things they need and save for the things they want.”

While the government is suspending the tax, it’s up to individual retailers to administer the tax break and remove it at the point of sale.

How long will the tax break last?

The tax break will begin on Dec. 14 and last until Feb. 15, 2025.

What products are included in the tax break?

During the two-month tax break, you won’t see GST or HST levied on the following items:

• Baby and children’s clothing, accessories and footwear.

• Diapers, both disposable and reusable, including training pants.

• Car seats including infant, convertible and booster seats that conform to Canadian safety standards.

• Print newspapers and books, including audiobooks and religious scripture.

• Christmas trees, both real and fake.

• Most groceries including prepared meals, food sold through catering services, and alcohol. (Excluding spirits.)

• Most prepared meals sold at restaurants, coffee shops, takeout vendors, pubs, lunch counter, concession stands, mobile food trucks.

• Children’s toys designed for age 14 or younger including board games, puzzles, video game consoles, controllers and media.

What products are excluded from the tax break?

While a lot of items won’t be charged a GST or GST during the two-month period, there are still some specific exclusions.

• Sports gear or equipment for recreational activities, even if they are meant for kids, are excluded from the tax break and you’ll still have to pay a tax on these items. That includes things like cleats and soccer or hockey socks.

• Electronic and digital publications are also excluded, as well as fliers, inserts, magazines, periodicals, brochures and pamphlets, sales catalogue, warrant or owner’s manual, blank notebooks, colouring books, scrapbooks, agendas, and calendars.

• Spirits and spirit coolers over seven per cent ABV are excluded.

This news from Vancouver Sun

Wishing you a joyful Christmas and a wonderful holiday season!

Wishing you a joyful Christmas and a wonderful holiday season!

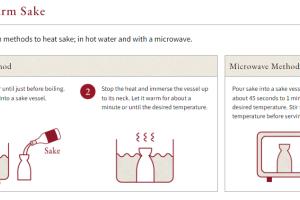

How to Warm Sake

How to Warm Sake